Operational Performance

As the impact of the COVID-19 pandemic gradually subsided globally in 2023, it was followed by the emergence of inflation and high-interest rate policies, along with intense geopolitical conflicts. These factors dealt a severe blow to consumer demand in the end markets and slowed down the destocking pace in the semiconductor industry. According to statistics from the Semiconductor Equipment and Materials International (SEMI), the global semiconductor silicon wafer shipment area in 2023 was 12.478 billion square inches, a decrease of 14.3% compared to the previous year. Sales amounted to US$12.3 billion, a year-on-year decline of 10.9%. Despite facing the challenges of a downturn in the macroeconomic environment, Wafer Works continued to explore various light and heavy doped wafers for use in power semiconductor devices, focusing on niche products and expanding into key markets. Albeit with headwinds, we posted a consolidated revenue of NT$10.048 billion and a basic earnings per share of NT$1.05.

Looking ahead to 2024, after undergoing a year and a half of adjustments, the global semiconductor industry is expected to gradually return to a healthy level of inventory. Coupled with the explosive growth of AI applications and the formation of regional manufacturing centers, there are opportunities to further increase demand in the silicon wafer industry. Wafer Works will strengthen the exchange of experience and resource sharing among subsidiaries, enhance the operational synergy of the group, and actively deploy 12-inch product lines and capacity to provide global customers with differentiated product services.

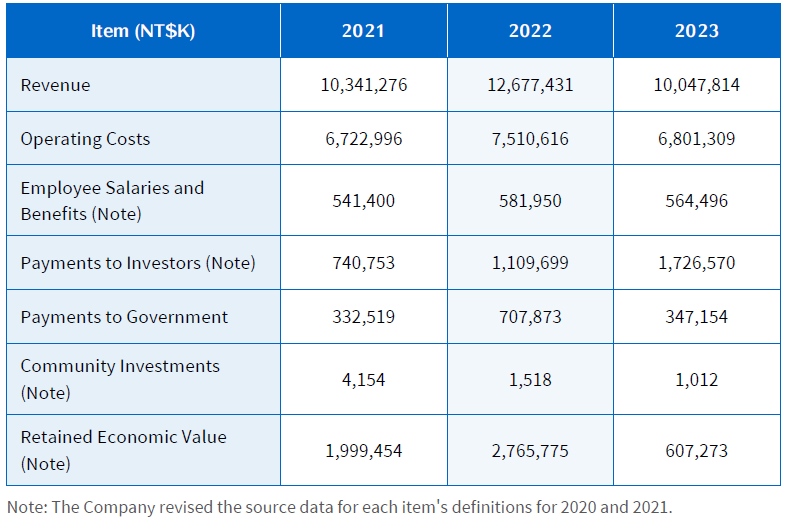

Financial Information

The table below presents various financial information for Wafer Works, including disclosure of employee salaries and social investments:

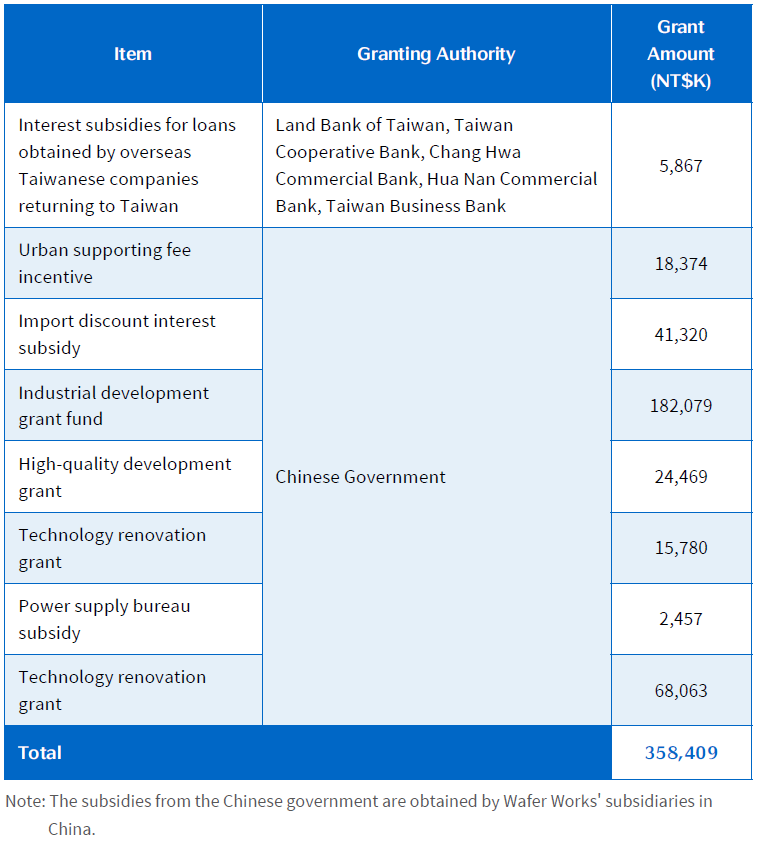

During the reporting period, Wafer Works received financial subsidies from the following government units: